The GINI Coefficient

Here's why factoring the GINI coefficient & the PGI (Product Gini Index) in could augur well for product managers…

The GINI Coefficient is used to depict income equality & here is its value across various countries of the world for the period 1992 to 2020.

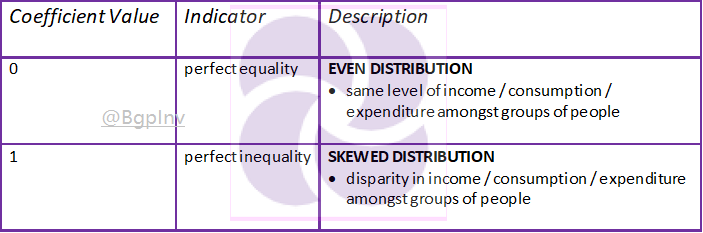

Built by an Italian statistician & sociologist Corrado Gini the Gini index measures the extent to which the distribution of income / consumption / expenditure among individuals or households within an economy deviates from what could be termed a perfectly equal distribution.

Let’s attempt to understand this better. Take a look at the graph below. A Lorenz curve plots the cumulative percentages of total income received against the cumulative number of recipients, starting with the poorest ones on the left extreme of the X-axis.

The Gini coefficient is expressed as a percentage of the maximum area covered under the hypothetical line of absolute equality (45o slope) when the Lorenz curve represents the actual distribution.

The deeper that curvature of the Lorenz curve from the line of equality (which could be considered the baseline) the wider the inequality, which goes without saying that a perfect 45o slope would never be possible for a Lorenz curve and that’s also the rationale behind terming the baseline as IDEAL / Utopian.

But is the coefficient bad or good all on its own?

Well. That’s the beauty of it, it depends on the manner in which it is interpreted which is what makes all the difference.

Firstly, one ought to understand that 0 doesn’t mean BAD, 100 doesn’t mean SPLENDID. For instance, take a look at the top countries consistently voted “the best to move into” according to www.usanews.com based on their quality of life. Their values are below 30 according to the map available on that website and the value of the USA falls between 40 & 45.

The value merely indicates how low or high the income inequality in those countries happen to be.

Another useful mention in this regard is the Product Gini Index (PGI).

PGI is a weighted average of the Gini coefficients of the countries exporting a specific type of product (refer image below).

You see how the distribution for something like Copper, a metal that is pretty ubiquitously used & found across industries has a higher PGI in comparison to parts of a machine that is employed to make a common commodity like say, paper.

But a major question that ought to strike you at this juncture is:

→ why should I even care about the Gini coefficient as a product manager or an entrepreneur?

And a simple answer is, it could play a very crucial role in understanding the psyche of your buyers / users.

But here’s an elaborate answer:

There could be many factors governing the adoption of products when they are tied to “price” which could be “the decisive parameter” and some of those are:

1.0 Needs & Wants

1.1 Are the users desperate about a problem & in essence a product?

If your users are desperate about a product given that it solves a MAJOR problem that they happen to associate with over their regular workflow, saving them tons of dollars or improving their productivity by changing the way they perceive the workflow, they are bound to pay even if it happens to be heavy on the pocket.

GINI Coefficient could provide one with the crucial information of whether the market is ready to spend on the product, and which section of them would be able to spend

For ex: Microsoft Windows XP & how it happened to revolutionize the home PC 2 decades back

1.2 Are there alternatives / choices to your product?

If the market isn’t mature enough it could be skewed in your favor. But if it is, then it’s quite possible that there are many competitors and products that are pitted against yours as potential choices. And once there is a choice, there always is a comparison which by default would branch into “what’s on offer” and “at what price”. But then again, if that competitive turf is neutralized by the product offering or unbelievable pricing it could successfully trump the competition although bracing oneself for an ensuing price-war could be more of a natural course.

GINI Coefficient could be clubbed with the other segmented data specific to a given market so as to strategically calibrate the pricing as desired

For ex: Mc Donald’s & Burger King and the competition over the years

1.3 Could we gun for more than just a mere fitment in solving a problem for them users?

Its quite possible that the market is mature and there may be many players who seemed to have carved their own niche in catering to various segments & pain points with each of them building their loyal customer base over a prolonged period of time. But, that doesn’t mean there is no room for entry for a fresh player in any stretch of the imagination. There’s always a great chance to make inroads into the market by differentiating & a lot would depend on how the brand chooses its positioning.

PGI (Product GINI Index) if factored in could prove vital in helping estimate market readiness over those viability tests

For ex: Apple iPhone and how they penetrated, redefined the market with their acute focus on UX & a much sturdy / stable device overall

2.0 Buyer persona

2.1 What would the primary interest triggering my buyers towards adopting this product?

People could get attracted to products for various reasons and the motivation behind adoption could really vary. It is crucial to understand the primary motivation behind the users buying into the idea behind the product without leaving too much behind for guesswork.

The PGI if tied to the market segments could help in determining the inclination of the users to spend alongside reasoning out the motivation

For ex: Rise of EVs and how that is tied to the cost incurred over the maintenance of petrol / diesel vehicles

2.2 Can I classify / slice up & study my buyers based on demographics & spending capacity?

When one talks of market segmentation and positioning the product targeting the right segment, it simply means that there is a certain demographic study that helps identify the exact age groups & ethnic groups who would be interested in the product, whose needs perfectly overlap with what’s on offer.

GINI Coefficient & PGI combined could help split the market naturally based on what they consider a NEED and tying it to their inclination to spend

For ex: Sony NW-A306 an Android portable music player meant exclusively for people who are actively into music & want to save on their phone’s battery

2.3 What concerns / blockers does my buyer currently have?

Not only estimating the TAM (Total Addressable Market) but getting down to SAM (Serviceable Available Market) & SOM (Serviceable Obtainable Market) over market research could augur well factoring in the spending capacity as well. Market estimations serve a purpose alright but that could mean nothing if the market is considered too tight to operate in, given how some may prove to be cash-tight.

GINI Coefficient could clearly point out the markets / geographies that are HOT or NOT thus improving the probability of success post launch smoothening out the path to adoption thereof

For ex: KIA launching specific versions of their cars tailormade to suit a geography & its demand

3.0 Price Positioning

3.1 Is the price point right for my users given what’s on offer?

It is more of a socio-economic thing isn’t it? As soon as there is a choice that obviously leads to comparisons of sorts which nobody has any control over, and that could all be led by subconsciously driven decision making. But given a product, one’s propensity to spend could lead to some really interesting turn out of events towards deciding the price point, more so if it happens to be the first launch and one happens to be a first entrant in there.

GINI Coefficient & PGI could help identify pockets of the world that’s more likely to adopt a given product once launched

For ex: Sting a premium priced energy drink from Coca Cola

Supposing there happens to be some competition, a price war is likely to ensue snowballing into some bitter fight for a spot on that retail shelf for many orgs. who don’t seem to come to terms with how they can really make their product offering more amenable to the users.

For ex: Newspapers or magazines catering to a certain niche audience

The understanding thus arrived at, ought to run its natural course in redefining (NOT REFINING) the product offering and coming up with what could be variants of the same product to suit those nuanced user needs stemming from wide segments of market naturally leading to TIER-PRICING.

For ex: Nestle Milk variants (Full cream milk, Low fat milk, Oat milk, Almond milk etc.)

Conclusion:

Remember to factor the [GINI index] & [PGI] in the next time you / your team hits the market up for research. That surely does make a lot of difference.