Strategy: AI Arbitraging

The concept of arbitrage could be leveraged well, even today in the AI era paving way for a wave of growth & this here is how…

The concept of arbitrage isn’t new at all. In fact, ancient times have seen many a strategy stitched around the very concept although it was largely restricted to essential commodities that were procured at lower (in fact at throw-away) prices generally from their point of origin given how there may have been no real bar around their availability & then transported to different parts of the world where there was no question as for its demand and a proven shortage of supply. This got the merchants a pretty lucrative market to cater to.

For ex: India’s monopoly over the production of cotton textiles for 3,000 years with the majority of the produce being exported to the East in general & the Europe in particular.

Definition:

“The book of economics puts the definition of arbitrage as the buying & selling of securities / currency / commodities simultaneously across different markets in order to take advantage of the pricing & pocket the difference”

Arbitrage pins & thrives on different perceptions of the same underlying commodity. If you stop to consider, the whole concept of arbitrage works on the way people of different geographies tend to treat / perceive / attach an exorbitant value on a given commodity for whatever reasons, the most common of which is the scarcity.

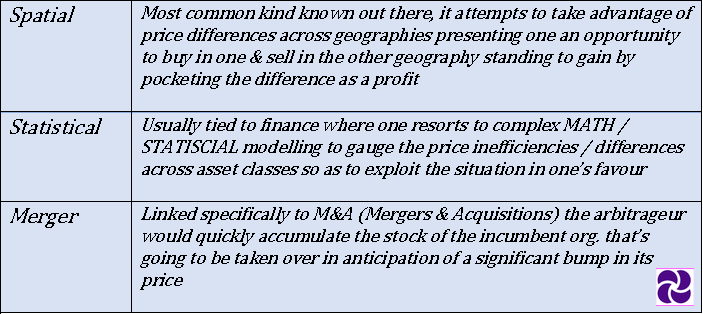

Having said that, there could be various types of arbitrage & Investopedia lists these 3 major ones:

NOTE: There could be tons of other arbitrages out there all linked to finance which I deliberately left out as it could be out of scope as for this newsletter.

So, how does this concept of arbitrage apply to the AI era? And is it even wise to apply arbitrage as a strategy to AI products?

Let’s explore this in depth.

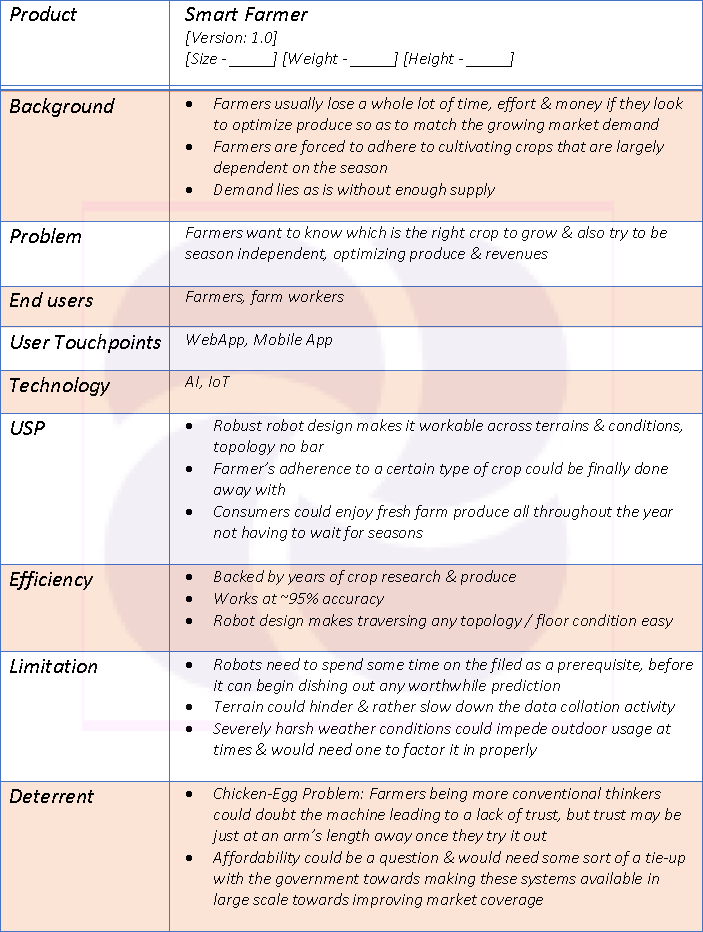

Take the example of an arbitrary product that can assist farmers by studying all conditions & giving them a break up of what to grow & when so to optimize revenues.

The reason that problem is worth solving is how there is this whole cycle time involved in planning, procuring, planting, culturing, nurturing farms right from seed to produce. And although many experienced farmers would be able to see the quality of the saplings & gauge / predict the Q & Q of the produce, there is good chance they won’t know it until the crops get to a particular stage. Moreover, forecasting could have its own ups & downs given many environmental conditions & variables involved.

Formalizing this understanding via a product SPEC:

Make no mistake. SMART FARMER could really have like a massive global appeal. But, one can’t just target the whole world at once as there could be many challenges specific to a geography / even a set of users / user groups. So, one needs a systemic plan / an approach towards conquering it all bit by bit.

Going by the theory of arbitrage supposing such technology is already present locally & could be procured without moving a muscle. Its best fitment would be at places that identify with all these conditions:

many ground-level problems

farmers having no real clue to tackle them

no means to access to such futuristic tech

Given how nobody would want to reinvent the wheel, the idea of an outright purchase could make total sense in this scenario as the incumbent is only worried about their cyclical produce & the revenues they can generate out of it.

Targeting a geography that’s has a severe demand but also has a supply gap given how the fickle weather conditions locally & lack of knowhow carves an easy natural route in for a readily available solution that works across terrain & conditions. Not only would the product see some perfect fitment, it could also have some more nuanced use cases / edge cases to cater to.

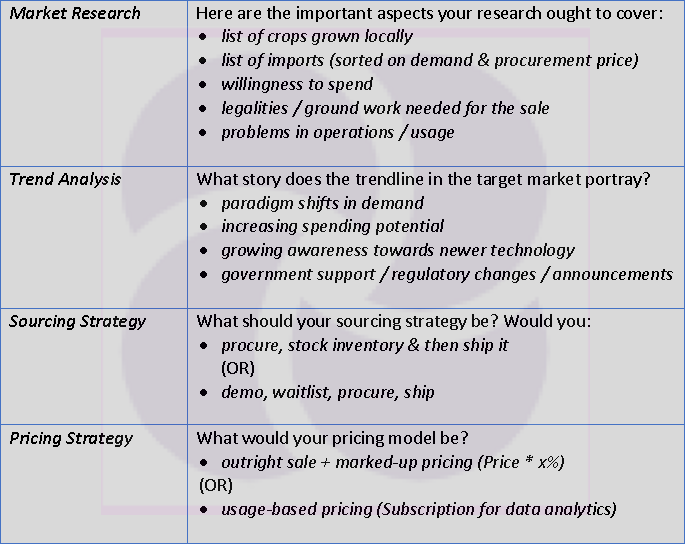

The concept of Arbitrage could act like a Godsend & open up new markets for any product. But, there could be a few deterrents & you’d find that your success so often hinges on how strong you are at all of these:

Market Research

Trend Analysis

Sourcing Strategy

Pricing Strategy