Power of Creation!

In between a VC & a PM who holds the power of creation? Who's a creator, who's a governor? Are there any skills that'd be perceived as inter-transferable or are they totally disjoint org. functions?

“I alone cannot change the world, but I can cast a stone across the water to create many ripples”

– Mother Teresa.

Who’s Who!

When the power of creation could be the most admired one across the world, it comes with a fair warning that any magnificent creation you see around you today has taken tireless, dedicated & hard work of a lot of people right from ideation, planning to execution & delivery.

Talking about Venture Capitalists and Product Managers when the services of one of them is crucial at stages that underpins the facilitation and the sole existence of an organisation, the other cult of people are essential at every stage contributing via strategy, planning & then taking tactical routes in executing those plans.

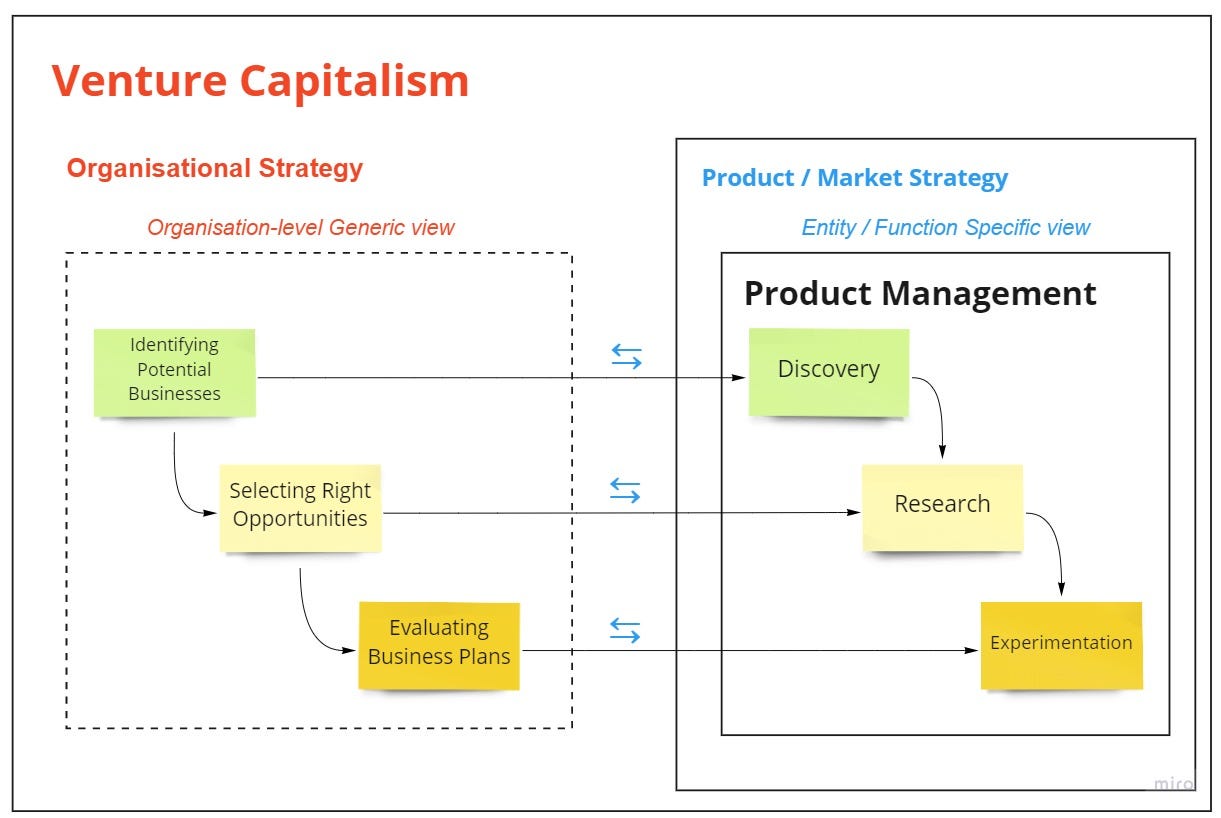

But having said that there is a slight commonality and an overlap that is mostly in the stages of planning & strategy with the only difference being one of them is directed high-up at the organisational level when the other works specifically at the product / market level building action plan(s) to put the organisation in that path of growth they plan to achieve.

Where & how do VCs & PMs fit-in in a typical organisation?

Duties…!

A VC - Venture Capitalist is someone who is a private equity investor - he provides for the capital adequacies of the people who own and run business houses / companies that are in need, post assessing them and conducting all due-diligence at his end as to whether they possess high growth potential in exchange for his equity stake. And, this could be funding companies / organisations at any stage from start-up ventures / supporting small companies that wish to expand but do not have access to it.

An organisation would need capital for a host of reasons from time to time when the most common reason is to satiate their own "scale-up" plans.

A PM could mean Prime Minister / Project Manager as well for many people. But, for us given the scope of this article we’d restrict it to "Product Management". For years now, people who are in product themselves have had a tough time over the generic definition of what Product management deals with in its entirety, a question that has led to many discussions, agreements, squabbles, disagreements, confusions, tirades over a period of time over social media.

Defining it in a generic way possible, it’s the process of researching & identifying needs and generating product ideas that could solve for those needs by envisioning, experimenting, validating the why, what and defining the how in building them adding value with a constant onus on making things better as compared to the current state.

Listing out some of the main functions and keeping it as generic as possible whilst trying to define the percentages of contributions over individual task-headers under which VCs & PMs operate, here is a graphical representation.

If these individual tasks from the graph were taken verbatim and plotted on a VENN, it’d seem like there isn’t a chief overlap between the two. But there is a striking similarity between at least the top portion of the graphs (as depicted over the figure in the previous section) and then it splits with one of them getting completely strategic and the other getting more tactical.

Idiosyncrasies

To be in a position where one has absolutely nothing to lose is just great. But in reality, VCs are so far from that. Each have their own idiosyncrasies and ways of analysing, picking organisations and the right founders / cofounders to invest in.

On the outset what may seem like “That’s a yes / no” has a lot going on in terms of analysis, drilldowns, vetting in the background and at multiple levels too to answer one basic question is to whether the idea / people behind the idea are investible or not.

“When you leave it to chance, then all of a sudden you don’t have any more luck.”

– Pat Riley

When VCs do take bets / chances, one thing to remember is most of them believe in taking a calculated bets wherein they try and get a hang of the uncertainties the businesses might have to deal with and also in figuring out multiple ways to combat those problems before they could turn into roadblocks.

So, the truth is, none of the VCs believe in taking blind bets.

In a parallel world, product management too doesn’t believe in building something based on someone’s whims and fancies and even if it used to be that way, it may have been a thing of the distant past. Yes. PMs do envision and generate ideas. But nobody progresses without the double-down into interviewing, asking, experimenting, studying, analysing, validating, learning based on facts and data they gather from the market’s / user’s end to support those ideas.

“Ideas may be the root, but validation is the base of every product”.

Common Ground b/w PM & VC

What are the similarities between product management & venture capitalists?

Could there be any transferable skills for someone who is into PM and planning to move into VC?

Most certainly! Yes!

There are quite a few of them no doubt, provided you already understand:

the big & the small pictures

the generic & the specifics

the zoom-out & the zoom-in

Let’s explore some of these in greater detail.

1. VCs don’t get rich by investing in 20 different start-ups all at once

“Diversification” is only but basic & mandatory in the investment’s parlance. It is only but natural that VCs would get crack-in splitting up their investments apportioning it over a portfolio at any given point in time.

How many companies does a VC invest in at any given point in time?

May be 1, or in some cases may be > 1 (depending on the corpus & the inclination)

Also, would all of their investments turn into money spinners?

Well, not quite.

Stats: In the past 10 yrs., ARR of VCs is about 15 – 27% as compared to the S&P yielding 9.9% in the same period. Also, the success rate of VCs is 1 in 2000.

Parallelly, no product organisation has ever achieved any major success by underpinning a strategy to build 20 different products all at the same time, simultaneously. In fact, the chances of success are brighter if the focus is on one single product solving for a few problems / burning issues the customers have.

2. VCs study a lot about the organisations they are investing in

Natural progression from the previous point is to be able to pick / prioritise one out of 20 and it is not something that’s done in a whim. One would obviously need some due-diligence and vetting of data, facts, figures et. al.

Many VCs tend to study a lot of things about the orgs, like:

Who is the management?

What’s the addressable market size?

Does the organisation have a competitive edge in the market segment it’s looking to operate in?

What are the key risks and contingency plans around mitigating / managing those risks?

What inclinations do the founders have post getting funded?

What is the vision the founders / cofounders of the organisation carry?

Parallelly, product organisations tend to allot quite a bit of time over the process of validation in getting a few answers and they employ teams with a clear aim, that is – to discover & research about the problem space, market, solution space, product, market fitment et. al.

3. VCs estimate the current position & the future prospects

Yes, you have a brilliant idea and all that sort of thing. But supposing you already have a business that’s up and running and seen some moderate growth, without the empirical evidence that would then lead to an understanding of where you currently stand as an organisation and how much of a growth potential you have, the idea may not get honoured and may in fact fail to go through.

Many VCs tend to put their cash-piles into organisations that have high growth potential. And, quite frankly this is a given, any day.

Parallelly, a product team may generate 10 different ideas and they may all seem top-drawer on paper. But those ideas have to be validated against the market / users / user groups by running surveys, interviews, experiments to scope the potential of user adoption pragmatically from the field.

Also, during research the whole idea of the product has to be pitted against choices already available in the market to know where the user’s stand as opposed to where the idea stands, justifying the need for the build.

4. VCs may not really fuss over your team size

Even though some VCs tend to ask a question or two about the size of your team, it may not be of any great significance to many of them as that is too granular a detail and getting into those would essentially lead to micro-management which none of them would want. VCs usually have other important stuff oriented towards strategic perspectives and pinned over their investments / returns / business / growth to pull their hair out.

Parallelly, though some PMs in some organisations do care about the size of the teams as it makes sense to get into that detail from an execution / deliverables / commitment standpoint, most of them wouldn’t really bother about how big the development / design team is per se.

That’s mostly the job of the Director of SE / SEM / Design Head and the PMs would be more than happy entrusting & leaving it to them.

5. VCs evaluate ideas based on how they’re going to be accepted by the target market

VCs may turn down some great ideas too over many reasons. A few of them may be:

idea doesn’t resonate with a large section of the audience

stagnation / don’t see propelled growth over a period of time

lack of interest over the solution / no potential foreseeable user base

doesn’t target the right problem / solves the problem partially

idea is too futuristic and market isn’t prime, not ready yet for that scale and magnitude of a solution given today’s time (this is rare, though not impossible)

Without the chief association of a problem to a specific market and its users, great ideas just tend to remain great on paper. And without that association all you have is big money, time & effort spent without much of a positive progress.

Parallelly, it goes without saying that PMs conduct their bit of due-diligence in getting a detailed picture of how their product is going to be received by the market they are catering to. PMs worry about user adoption much in advance than any other team would over collecting and analysing patterns of user behaviours & attitudes as they are assigned with the ownership and are responsible for the overall success / failure as well.

6. VCs give utmost importance to the multi-fold potential an idea has, it may not be in their interest otherwise

Just as everybody else who is in business, VCs are also in it to make money. And beware, they have access to all the other investment vehicles already available and known to common man. So, what is it that could set it all apart for them in investing over ideas that other people have, at times with some founders carrying no solid qualifications / technical background either?

It’s got to be only one thing mainly and that’s the potential they see in the idea itself / people behind the idea.

SPECULATION had it that top-bracket VCs look for potential businesses to reach the IPO stage atleast at a bare minimum level before they agree on investing into it. And, for all you know that may be true as well.

Parallelly, if a Product team is able to generate 10 different ideas targeted at a certain goal they have been asked to chase, they tend to go by analysing which one of those ideas may lead to the highest results (not necessarily ROI) and (also minimal effort in some cases) prioritise that one over the others provided they align with the vision.

PMs are a value-add!

What’s the chief value addition a VC organisation / independent VC individual would get by onboarding a product person / even hiring one by the hour - one may ask?

Off late, I’ve been noticing a trend where it is really amazing to see how some of the world’s best VCs are wanting to hire product people, leaders with well-rounded experience in product management. Well, the role is not the usual stuff product management deals with right from envisioning, ideating, hypothesizing, validating to building, releasing, scaling & growth of products in question. It is more into validating and vetting ideas.

Who other than VCs can understand the pain of estimating based on assumptions and then going wrong over it?

That’s probably why some VCs have got into a deeper and closer relationship with the people they invest in

Some handhold and help take those products / services to the markets on which they have stronghold over, given their years of accumulated experience.

Most of them heavily restrict themselves to streams / fields they already have expertise in, completely shunning themselves away from the others.

And, given that PMs resort to taking well-informed decisions that are data-backed and validated at each stage be it a new product / a feature addition, it makes sense for VCs to onboard a PM team as they’d fit the bill in tackling problems represented by the three points above. It would then help them gain a deeper understanding with a perspective & spill the beans over target markets, users, needs / pain points whilst also helping gauge the immersion levels & the effectiveness of those ideas.

NOTE: -

A reminder to any of you VCs operating in individual capacity / an organisation reading this here. In case you are / you know someome who is on the lookout for any such services, feel free to drop me a line at bgp.inv@gmail.com.

To conclude:

Both VCs and PMs have been bestowed with the powers and are creators in their own right.

And, no doubt there are many transferable skills for you as a PM transitioning into VC provided you are endowed with all the necessary cashflows and are inclined towards it.

What’s more probable would be the way VCs and VC organisations would need the services of PMs in vetting organisations and their prospects over a few dimensions and in detail.

Credits

The cover image used here in this article is a painting called Nature Vs. Nurture by Randy Grskovic.

If you enjoyed this, then please:

Do like the article

Do share it with your peeps

Follow me on Twitter by clicking on the button below if you are interested in daily updates on product management, strategy, teams, culture alongside some occasional banter / exchange of thoughts over the product community

Thanks a lot for reading! 🙏