Fluidity in VUCA

Here's how you could handle the uncertainty induced by environmental factors...

The most important factor that underpins the success of any product in specific or a business model in general is the STRATEGY, which could be simply put as a direction the leadership tends to define so as to ensure that teams attain an end goal over a given period of time.

Given a small team of say 10 people at a startup org., the amount of time they spend on discussions, planning, brainstorming & getting things in order over why it makes sense for them to take up an initiative & how to go about it all towards reaching that outcome ought to take up a significant slice of time (~ 40%) first-up. As for large product orgs. / mega corporations that could take up (~20%) a rather lower time slice.

Although the industry average says the time allotted towards strategy (planning):tactical (execution) is 20 : 80, the one thing that one ought to remember is how the environmental factors could be pretty static, as in the situations may not change that rapidly.

To understand this better, let’s consider a Fintech org. looking to launch an App that helps users seamlessly track markets across asset classes & geographies.

The data points may not change although the source could dynamically change based on which asset one is looking to track. One could be interested in tracking prices of various orgs. whose stock are listed across the NYSE (New York Stock Exchange), LSE (London Stock Exchange) & DAX (Deutscher Aktien Index).

The strategy that goes into largely defining the inputs over the data collation activity, the major indicators that are followed & do matter to most, the way one ought to think about displaying it, rendering it over the best UX as for the App is what represents the environment.

And it is worthy to note that, that may not change & is largely static making the whole execution pretty straightforward which could also justify the 20:80 RATIO as for STRATEGY:TACTICAL work as well.

But, assume the org. goes a step ahead & now thinks about adding market predictions as a new feature. The strategy would now span the whole breadth of the market, the macroeconomic / microeconomic factors, some specific geopolitical scenarios, government policies & the sectors they tend to favor / disfavor, performances of individual companies across seasons just to name a few at the very top, although the nuances one could cover here could depend on the sophistication levels one is planning to set & achieve.

Do you get a measure of the complexity?

Now, just raise that complexity to the power of (n) where 2<n<nn) & that could be the complexity defining the dynamic environment how one to factor it all in over every one of those asset classes given how the rules governing them could induce more fluctuation over the prices. To factor all that dynamism would then call for a degree of Fluidity over the strategy itself given the inherent need to adapt to dynamically changing circumstances & allow the system to evolve stepwise.

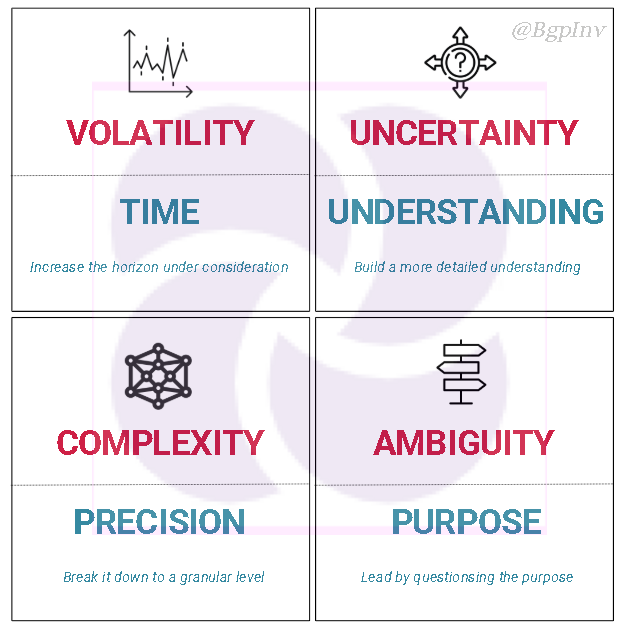

Such dynamic & complex environments that could be highly unpredictable in nature go by term VUCA (Volatility, Uncertainty, Complexity, Ambiguity)

If you decode the “UNPREDICTABILITY” it could get classified under any one / more of these buckets:

When unpredictability looms large, it could get pretty hard to even keep those thoughts straight, let alone being able to formulate a strategy.

So, what’s the escape route from here?

Let’s go addressing each one of these causes whilst extending it to the fintech example that was discussed earlier.

1) Volatility

Remember the classic saying about volatility when it comes to the financial markets? The one way to deal with volatility is to expand the horizon under consideration. Turns out the markets world over are at their volatile best, almost always. But, why should those small up-down movements, repercussions even matter to one when they are not planning to get involved / participate actively in the markets on a daily basis. It is certain that the rat race isn’t worth it, you know, where one’s daily performances are pitted against the other players in the market so as to rank in descending order of winning deal sizes.

🔑 Key here is TIME!

Biding for time with those investments & increasing the horizon under consideration (provided one’s ticked off due diligence & contingency planning) with of course a properly scoped strategy map could be the wisest thing to do given a moderate - high risk profile.

Essentially the approach here is to gather as much information as possible about the parameters inducing volatility & factoring them all in to an extent, arming oneself with enough situational information so as to be able to make decisions. And the one thing that could help a great deal here is the VISION. The vision of the org. ought to be the yardstick given how any major / minor initiative ought to align with that prior to it being given the go-ahead. What one could also do is to gauge the intensity of the volatility across a variety of changing situations & understand which ones ought to be given heed when also pondering over which ones to drop entirely.

2) Uncertainty

Where there is volatility one’s bound to feel pretty uncertain about the next move, gripped by a sense of skepticism over whether or not one’d be able to get where they want to get by taking a certain route. Talking of uncertainty, the stock markets could have ample examples over a daily routine. Positions could get diluted with advantage being nullified within a matter of a few seconds given how a certain non-favorable outcome (and mostly the speculation of it) could play its part in setting off a degree of panic. But the experienced ones know how to play to it all. They happen to get to a state of balance & possess a total understanding of the elements that induce this so-called uncertainty & chart out detailed plans as to how they would tackle it all.

🔑 Key here is to gain a more detailed UNDERSTANDING!

Times when one is unclear / uncertain about the next steps to take in the market owing to its current condition it does help to get one level down & understand the factors that happen to be the reason for the whole uncertainty.

The approach as is evident is to look for more nuanced information, get down to those details, understand those root causes, gauge the level of impact scoping & making it easy to factor those positives & negatives in. Given such a circumstance, getting down to analyze each of those root causes for all the uncertainty could work its way up to arm one with the right information & help / facilitate better decision making. The most significant stub responsible for inducing the uncertainty ought to be underpinned & solved (/found workarounds) for.

3) Complexity

The complexity of the stock markets has been a reason for debate for long now. The factor(s) inducing the volatility & that leading to a level of uncertainty when analyzed could be found to carry a certain degree of complexity & that could at most times be significant proving a handful to tackle. And given most things in the “observable universe” today, complexity happens to be a factor of the magnitude of information that one tries to process over a given instance / over a certain silo. Most times it is possible that one is looking at a situation as a whole & just can’t help but feel psychologically overburdened by it all. What’s the best way to deal with complexity? Break it down into small manageable chunks of work, modularize the whole situation so as to read it well, be clearer about it all.

🔑 Key here is PRECISION.

When “which stock / asset should I pick?” is such a common question, it is also a very high-level question. The likelihood of many of them finding the answer to it could be near-zero because of lack of detailed understanding of the grassroots / the granularity could be well & truly missing. So, breaking that question down into its elements, meticulously dealing the nitty-gritty, proceeding with a degree of clarity ought to be the mantra here.

Chances are you are going to eventually succumb & fall out if you begin approaching a problem with the complexity of it all always prying on your mind. The psychological pressure it would build up could get absolutely daunting to tackle leading to many a brain-freezes. The one simple thing one ought to remember to do when dealing with complexity of any degree is to get down to the elements, what’s it that defines the complexity in the first place? It is possible that one may arrive at a first-level break-up of factors but probing it further down across a few more levels ought to lend enough clarity over dealing with the situation. Remember, sometimes “taking no action at all” could also work out to be a great strategy as opposed to marching ahead with some vague conviction.

4) Ambiguity

Post analyzing the complexity it is possible one may arrive at a few alternatives. Most times those routes could look pretty clear handing one a clear-cut step-wise plan of action towards getting to an outcome, which is pretty straightforward a case. But, that may not be true as for the case of the App targeting stock market predictions. Think of a jukebox that plays music what could look like some random order defying any set theory / logic & that description would just fit the bill here in the App’s case just as well. The problem may just not be about “what fits where” but “what one ought to fit where so that the result is optimal”. The definition of optimal could be expansive in real life making it visibly & impossibly tough to put a CAP (defining the CEILING – the maximum level that it can reach) on.

🔑 Key here is PURPOSE.

When in doubt consult the manual & when in any sort of doubt / vagueness over the outcomes, tie it to the purpose by asking “what is important right now” & try to reason it out with a “why’.

The one trait that’s known to trump ambiguity is of course clarity at a basic level, but that also calls for a great degree of agility over the patterns, the logic that goes on to represent the interpretations, the algorithm that defines how to reach optimal success. Sticking to one algorithm / rule as a dogma may not augur well in such dynamic environments. The only thing would work is to put oneself on a consistent testing pedestal, so as to be more focused on achieving the outcome, drop the other stuff as noise (which may as well include methods that worked well & yielded handsomely in the past) whilst adopting the changes, walking with time, changing dynamically as per the nuances of the individual situations.

Remember:

Dynamically changing VUCA environments call for a sense of stepping back, carefully scoping / analyzing, getting a measure of the complexity & building a plan of action whilst being totally aligned & introspecting / questioning every major / minor move before marching on.