Dynamic KPIs

Which type of KPIs would suit you the best over changing market needs & having to factor them regularly into your workflow…?

Is anyone short of aspirations today?

Well, I totally doubt that.

There could be no real problem over the aspirations given how most people are well-informed today owing to the reach / depth the internet has. Aspirations could be thought of milestones on a map given someone’s quest / journey but still they would prove to worthless if one happens to be driving in the wrong direction or even worse - staying immobile by not driving at all.

This quote by Peter F Drucker is a reminder of how important it is to keep track of the progress over a regular cadence & steering those tasks / initiatives undertaken towards reaching the goals, which could apply both personally & professionally as well.

Picture this. If someone’s a sprinter, it is very obvious that their speed is being tracked regularly over every run even while at practice, so as to create a motivational push towards beating their own record that was previously set. When that’s crucial alright, would it even possess the same amount of efficiency if they happen to be totally unaware of their competition that includes someone who may hold a record of finishing a 100m sprint under 10 seconds?

You see how many insights (lessons) one could glean from that analogy:

not measuring / tracking performance is NEVER an option

merely measuring / tracking anything may not suffice

measuring & tracking sans factoring the competition in would to be daft

tracking leads to improvements ONLY if one has a proper action plan / goal

continuous improvement is proportional to the frequency at which one relooks those goals so as to reassess & realign oneself

Extrapolating the same analogy to product management, it is very natural that one begins to think about the Analytics, the KPIs & the Metrics in the parlance of goals & having to measure / track progress. When the KPIs are known to drive teams towards achieving those goals, they could have quite a few flavors to them which is something we shall cover in detail over this article.

Definition:

KPIs (Key Performance Indicators) are used to specifically measure the performance of a business objective & tracking / measuring it over a period of time against some targets / milestones would lead teams to improve continually.

So not only do KPIs have to be easily quantifiable & measurable, they also ought to categorically act as a fine print of performances directly / indirectly tied to the health of the business, leading teams towards making better decisions.

Some commonly heard examples of KPIs are:

Inbound leads to improve by 5% every month

Sales growth to hit a minimum of 7% QoQ

Sign-ups from social channels to improve by 10% this quarter

No. of visits to the storefront to rise by 5% MoM

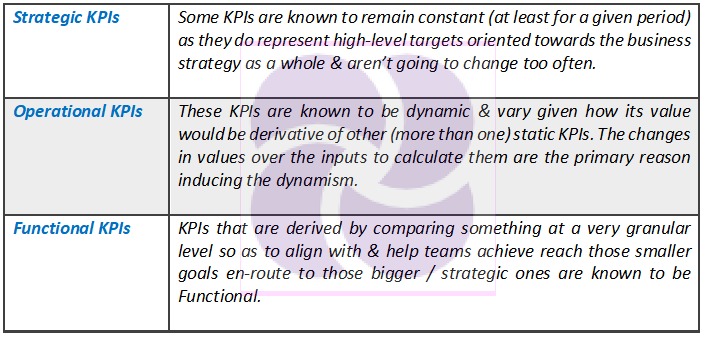

Types of KPIs:

KPIs are known to be broadly categorized as:

qualitative (point to the health of the business / a measure of user loyalty)

quantitative (revenue targets and the like)

They could also be classified as leading / lagging depending on the underlying metrics they are derived from. When there’s been a long debate about the leading ones being de-facto & the lagging ones not serving the purpose greatly, that’s totally a myth. There could be situations in some business where pinning on lagging indicators makes more sense given the timeline of reporting coinciding with the accruals.

But here’s a pretty fair categorization of the KPI types:

Let’s get down to a case study to understand this better.

CASE STUDY: RETAIL BANKING

Supposing there is a retail bank that has been operating for around a year and a half now. They have a sizeable customer base but are about to hit that ascension point now. And, the leadership gets down to understand how they would need some goal-setting and KPIs for all teams right from the EXECs to the middle-level managers to adhere to.

So, they first get into defining a goal which could be something on the lines of:

“Get a foot into the list of 10 fastest growing banks by the end of the fiscal year”

Lets’ get down to understanding how they could frame those KPIs including the clarity on the specific areas they plan to target over the next 12-month period so as to get them to their goal.

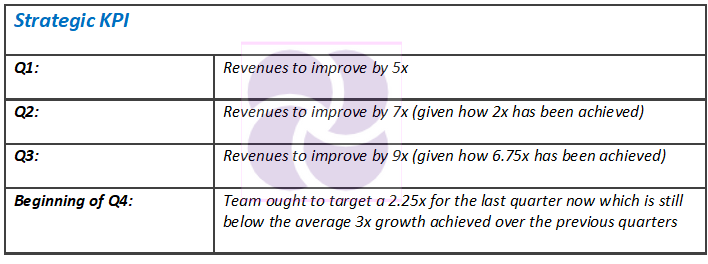

1. Strategic KPI:

The need for a strategy is a given in this scenario & that would obviously set direction for all the teams involved. And that could be achieved via a high-level KPI, which won’t change rampantly based on seasons and would remain constant throughout that window of time. To make it to that list of “TOP-10 banks”, one of the basic & preliminary parameters to pin on would be REVENUES.

So, naturally the strategic KPIs could look like:

Revenues (ARR) to improve by 5x, this fiscal

2. Operational KPI:

Now that the high-level goal and the direction is set, the necessity to get down to defining the details over what could be considered a roadmap is desired and so is the further breakdown of the KPIs. For Revenues to be bumped by 5x, teams would obviously look that strategy to also offer some kind of clarity over how they are going to get there.

Revenues for a retail bank is an aggregate of revenues from all the individual branch operations across all the locations & each of them is known to report varying CASA (Current Account Savings Account) balances owing to many factors like reach, awareness, trust, user’s perception of the value & the benefits of locking their money in a bank that’s just kicked-off operations a few years back, inclusion etc.

But each branch would have their own KPIs adding up to the total revenues for the given fiscal, roughly something one the lines of:

CBD (Central Business District) branch revenues to improve by 7x

Mid-town branch revenues to improve by 4x this year

Town branch revenues to improve by 1.5x this year

3. Functional KPIs:

There’s more clarity now given how there are KPIs set at a branch level as well which is well and truly location-based, justified by the footfall at each of these individual locations. Financial inclusion could be very tricky over those town-based branches, blame on it jitters / safety concerns motivated by many a Wall Street debacle.

With that goal in sight it is important to get down to the how. It is possible that different branches face varied set of challenges in onboarding users & one of them could be the services offered at the branch level. Supposing the bank launches a very attractive investment scheme alongside the account opening, that could perhaps open up the floodgates over the sign-ups & one could also aggressively gun for referrals from the existing users in exchange for a small & worthy gift.

Given this scenario it makes sense to track the no. of individuals onboarded & willing to invest into this new scheme that not only promises capital appreciation over a period of time but also does it without too much of a capital risk:

For B2B:

no. of current accounts opened & A/C balance > 5,000

For B2C:

no. of saving accounts opened & A/C balance > 2,000

By tracking the number of accounts opened with a healthy balance, pitching the investment scheme could be natural. Its not to say the ones with balances below the threshold may not be a worthy prospect. But, that could be the next step in the roadmap to hit up those accounts as well over a cold call. It is all about optimizing time and effort towards optimizing for a goal.

Dynamic KPIs

It is evident how the tech scene has undergone a paradigm shift over the recent years & that has no doubt rubbed off on the markets and the user’s expectations, which points at this rapid & pronounced wave of growth.

To be able to cater to such a market demand, one simply needs to be more dynamic in their approach, in the way they build those products & features taking them from 0-1 & more importantly planning & identifying ascension points so as to be able to onboard that growth wave at the right time & ride it. And that calls for teams who can constantly play the watchdog tapping into market expectations, helping factor in knowledge gained into product development efforts ensuring that it leads to growth.

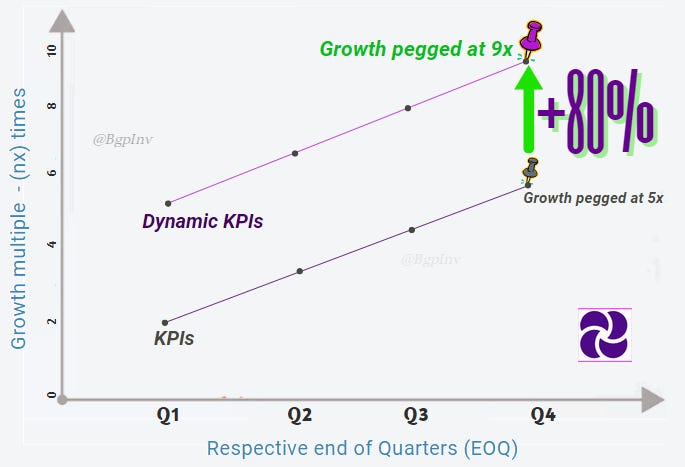

Going back to our case study of the retail bank & harking at the KPIs that have been set, one ought to realize that the Strategic, Operational & Functional KPIs seem to be STATIC in nature, which don’t change at least for a given timeframe.

But a worthy question to ask now would be:

Is that worthy enough to crack the growth levels we want to achieve?

And would that suffice to put us well & truly ahead in the race?

Arbitrarily speaking, assume your competitors are growing by an average of 7x, you’d realize how that strategic KPI you set when you started (ARR to improve by 5x) may look like it is totally off color now. Reflecting on it & the strength / capabilities of your teams, you begin to understand how those KPIs are sort of undermining the abilities of your own self & your teams as well.

One way out of that is to use Dynamic KPIs.

A dynamic KPI would be tied to a host of market indicators that truly tap into user behavior & factors all those expectations in. Given how it’s a constantly changing market, the KPIs would have to be subject to evaluation periodically as a function of the outcome & time on hand.

In our retail banking case study, this could spawn out like:

And of course, taking a cue from these changes over each quarter, the Operational & the Functional KPIs would now get re-evaluated & calibrated so as to support the expected growth numbers. When that may not look as simple as merely stretching the expected numbers over the investment scheme across CASA, teams may have to look for alternate GTM routes to improve the probability of hitting the targets.

NOTE: Dynamic KPIs aren’t meant for all products & markets. They hold good selectively & could also end up acting as a dampener given how teams may have to deal with changing expectations quarter after quarter. But, it still makes total sense to implement & adhere to them when the org. / product has hit an ascension point & it calls for some aggressiveness over the growth phase.

Reminder:

Contrary to common perception, it’s not that someone using dynamic KPIs are touted as the best & those employing the static KPIs aren’t up to the mark. It’s about factoring in the goals that have been set, assessing / reading the situation thoroughly, earmarking target areas to hit & help teams with a clearer picture of where they stand currently spilling the beans over the gaps between their current outputs & the outcomes so desired.