4 *Mandatory* checks to strengthen your Market Research

Here are 4 crucial checks you ought to subject your market research to before you can finalize it & term it good to go:

Ever faced the product valley of death, where you get into the mode of asking the users for exactly what they want to see on screen in the name of research and then spend the whole time building exactly that & nothing else but that, only to be met with a hopelessly cold response leading to a realization of nobody being interested in it post-release?

This is also one of the things that Melissa Perri talks about in her bestseller - “Escape the Build Trap”. To be able to break this cycle, one ought to drop thinking entirely from the perspective of outputs (the deliverables teams have been able to knock off) to outcomes (how & what value are we going to add to the users by building (x)).

There is a certain degree of difficulty (wherever & whenever applicable) in adhering to outcomes and that’s got to do with the overlap it has with understanding user behavior, which intern shares a quaint intersection with market dynamics bringing it down to the quality of research being conducted.

Although (and I think I can say this safely) every org. today understands the importance of conducting research with ample time & money splurged, many still seem to land into the death-valley without a clue as to how they got there.

…which to a degree emphasizes that it isn’t the amount of time (QUANTITATIVE) that goes into it, but the relevance & importance of the findings (QUALITATIVE) stemming out of that research which ought to be the focus for teams.

Verbatim:

Cofounder: I have had this amazing idea & I just wanted to run it by you, get your inputs in

1. So, I’ve been thinking of building this (x) product as I pretty well identify with the problem myself as vouching for as many others in the market just as much

2. And I’m sure the idea is pretty novel & nobody is working on it right now

3. I’m thinking & trying to focus on a really tiny scope right now as I’m pretty sure this can blow up into a mighty one over time

Product person: [hears it entirely, understands the idea, digests it, gets down to work]

(… a few hours later)

Alright, I have a few questions here stemming from my short research that somehow seems to negate all 3 points you had raised over your last discussion

But saying qualitative could really cover a pretty wide spectrum of aspects, literally almost everything under the sun.

Here are 4 mandatory checks you ought to subject your market research to so as to cover all loopholes, strengthen it & make it stronger / relevant to the markets & the users:

[NOTE: Ensure you follow this for every feature build that you undertake over the PLC]

CHECK 1: The Behavior

Can you explain why yours / competitors’ brand(s) / product(s) are purchased in the first place?

In being able to gauge & arrive at the user’s & collectively the market’s behavior that’s one of the first questions you should pop & be able to find unbiased answers to.

Really, it can’t get more simpler than “why does someone buy my product?”

There could be many reasons that the user groups could come up with when you interface & happen to ask them for “THE REASON” why they like a particular product and keep coming back to it. Taking notice of all the reasons and arriving at how the users perceive value whilst pitting them against what could go on to supposedly define your product’s positioning at a later point in time ought to be the very first check your market research out to pass.

With competition being cut throat it doesn’t take much to lose market share if one is complacent over a single feature product’s release. If anything, the current market trends do stand a strong testimony to some constant innovation in solving major problems as relevant to the users of the target market.

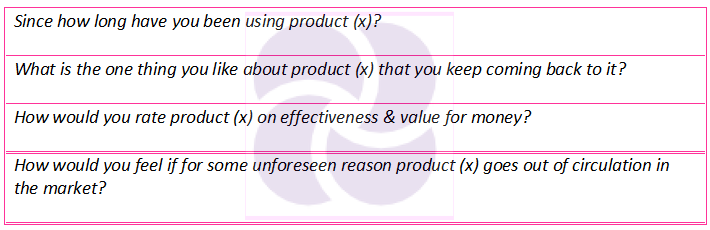

Some questions of semblance here could be:

When it is possible that the reasons could be the same over a sample space, the TRICK here is to see if the status quo is maintained over those responses which could point to some state of monopoly or some absolutely impeccable customer loyalty or if they happen to dynamically change within a short cadence which could point to some pathbreaking changes in the market driving user’s expectations forward.

CHECK 2: The Problem

Are the research methods employed by your teams truly user-centric & help identify the problem?

Being truly user centric would mean thinking from the user’s perspective, ENTIRELY. And when one is doing that meticulously, it obviously ought to stack the odds in favor of deeply learning a thing or two about their pain points / problems that they themselves may be unaware of.

It’s all down to, “what problem am I solving for here?”

It is possible that the competition is dishing out release after release & on a regular cadence as well. But just based entirely on the cadence & consistency of releases assuming that they have a grasp / understanding of the whole market may not always be right.

Its all down to release strategy sometimes, some orgs & teams look to release as in throw it out to the users to test it LIVE on the field when some believe in cooking up a single-feature MVP subjecting it to some testing with a close-knit group of users & then allowing that feedback collected to drive further development / release thereof.

Please understand that there’s no wrong or right here as for the strategy, it could be dictated by a lot of internal / external factors & more so when all that one is looking to accomplish is to stay ahead of the competition.

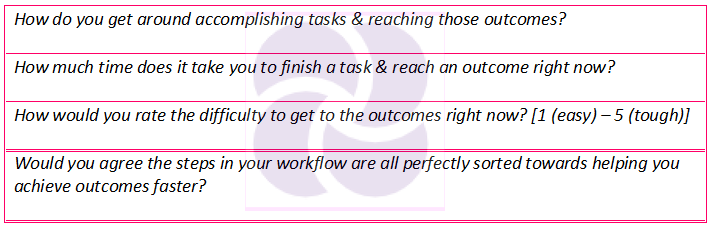

These questions ought to help you arrive at & emphasize the problem:

As much as you get your hands on these responses it could augur well if someone from your team go down and spend some time with the users, being a fly on the wall just observing keenly, scoping all their activities or how they go about their workflow taking notes constantly. But, you could watch out for a few polarizing responses over these questions that could point to some deep pain.

CHECK 3: The Innovation

Does your research justify your need to induce & their propensity to adopt innovation?

When many product teams across the world know and understand the importance of innovating and also allot a huge chunk of time to it, statistics point at how that those initiatives have fallen terribly short of putting the organization where they perceive / intend to be post launch. One prime reason for that is the major focus drift from “problem solving” to “thinking about technology & innovation”.

Unless one is asking the question

“is this the right way to solve the problem & would this snippet of innovation be accepted widely?”

and looking to get some relevant responses from the user groups who matter, the odds are - the product may fall flat in terms of adoption.

Sometimes innovation could be driven entirely by competition and their approach towards solving a particular problem for the user groups. When there is nothing entirely wrong with that, it would help if there is ample time spent exploring the problem space & then moving on towards the brainstorming in arriving at the solution.

Yes, it is all about who has their noses in front, but in the same breath there’s always the propensity of the market to gravitate towards something that impresses, in spite of it arriving a little late beating down the myth of bad timing. Having said that there’s nothing that could counter the strategy of release cadences aimed at continuous learning from the market & turning the VoM in your favor eventually.

These questions ought to help you establish the solution course to the problem in question:

Iteratively working on the product in terms of design, development by factoring all the answers / feedback to these questions could be the best way forward given how the scenario is bent towards gauging experiences & course correction of the product offering.

CHECK 4: The Differentiation

Is there enough evidence that the perceived value is beating the competition?

Given a product and a target market, there could be some truth in the fact that “not only worrying about what your strategy is / what you are building, it is imperative to gauge what your competition is building and what they are strategizing over”.

Gauging attitudinal information over “how do you feel about the way the problem has been solved?” does add impeccable value in shaping the product and helping you differentiate from the competition in the market.

When so often differentiation does get tied largely to the solutioning part of it, there’s always ample room to differentiate over the strategy & the strategic initiatives just as much for that could often be the decider of how the product would fare in the market post launch.

A common antipattern and word of caution here would be to NOT FOLLOW the competition blindly. When it is possible that there may be a few products in the market already and they may have a healthy market share as well given their solution course, that shouldn’t be an alibi for you take the same solution route in terms of innovation / differentiating it.

Some mandatory questions that you ought to find answers to over that research are:

The trick here is to study the problem the users are facing right now & also the competition and the popularity of the most recent solution. Sometimes this information could be obtained pretty simply over a session of moderated testing if a survey doesn’t seem to work, not to mention the depth of awareness you ought to possess over your competition and their product offering released thus far which could again be as straightforward as taking a trial and playing around with it for a while.

“There ought to be absolutely no harm in subjecting teams to another spell of research in case it proves to be broken, it is certainly far better than going ahead & building it”